Zakat, or the alms-tax, is one of the five basic tenets of Islam. Its payment is obligatory, at the minimum fixed rate of 2.5% per annum, on all wealth that is subject to growth. It takes the form of the giving of alms out of one's own private means. This amount is given in the name of God and is to be spent on worthy religious causes and on meeting the needs of the poor and the helpless. Zakat is an annual reminder to man that everything he possesses belongs to God, and that nothing should, therefore, be withheld from Him.

Man himself plays only a very small part in obtaining whatever he owns in this world. Were he not to have the benefit of God's endless bounty, he would neither be able to grow grain, raise cattle, set up industries nor accomplish any other work of a useful nature. The system of life created for him by God, fulfilling all of his requirements from those of his inner being to those of his external environment, is one of greatest perfection. Were God to withdraw even a single one of His blessings, all man's schemes would lie in ruins and all his efforts would be in vain. All productivity would grind to a halt, and life itself would come to a standstill.

Society should be so ordered that people fortunately placed in life come to the assistance of their less fortunate brothers.

The observance of Zakat is a way of acknowledging this fact of life. Islam desires that private wealth should be considered as belonging to God, and therefore should be spent in the way as ordained by God. In doing so, no one should consider that he is conferring a great favour upon those less well-endowed than himself, and should in no way be condescending to the recipients of his charity. When a man gives alms to others, he should do so with the knowledge that they have a rightful share in his wealth, for this is as God has ordained. He is doing no more than giving others their due. But when he gives, he can feel reassured that he himself will be given succour by his Maker on the Day of Judgment. In giving to others, he knows for certain that he will not be denied by God at the Last Reckoning.

One's Responsibilities To Others

Zakat gives a clear indication of what one's responsibilities to others should be. Everyone is required to recognize the rights of others, just as everyone is expected to sympathize with those afflicted by adversity. This feeling should be so well developed that one has no hesitancy about sharing one's possessions with others, or coming to their assistance, even when it is clear that nothing can be expected in return. Even where there are no ties of friendship, one should be a well-wisher of others and guard their honour as if it were one's own.

Gifts From God

Zakat brings the realization that all of one’s possessions are gifts from God and makes one more keenly aware of the virtues of devotion to God. In the light of such awareness, one cannot remain insensitive to the needs of the society in which one lives. Zakat is a perennial reminder that a selfish stance is a wrong stance, and that others must be given their rightful share of our earnings.

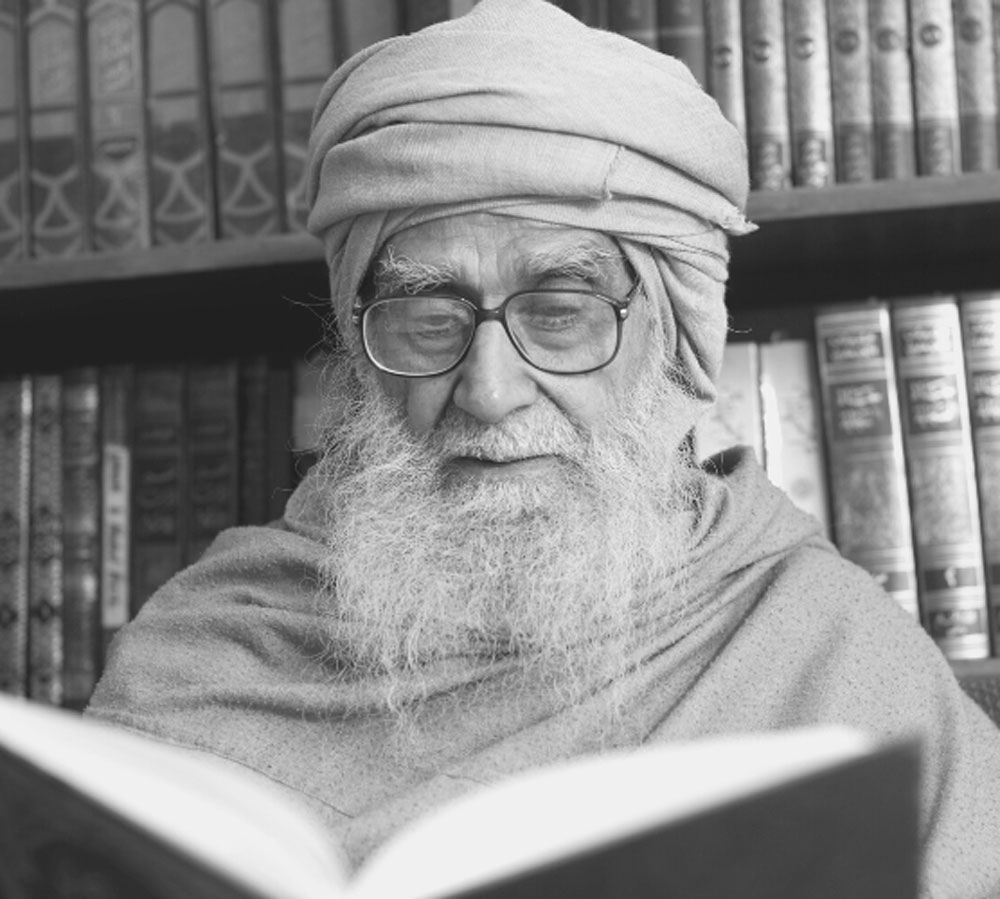

Zakat is in the nature of an annual reminder to man that everything he possesses belongs to God.

One unfortunate aspect of human relationships is that people tend to give to others only when they hope to gain something in return. Money, they feel, should be returned with interest. When such an understanding becomes a factor in our social organization, exploitation becomes rampant; everyone is ready to plunder everyone else. This results in society falling prey to oppression and disorder.

No one — no matter whether they are rich or poor — can be at peace in a society stricken with this malaise. Society should be so ordered that people fortunately placed in life come to the assistance of their less fortunate brothers, in the knowledge that they will ultimately be rewarded by God. Believers have the assurance of God that if they give to others, whatever they give will be returned to them many times over in the next world; their trust in God's promise is complete. In a society ordered in this way, feelings of antagonism and indifference are not allowed to develop; people are not bent on exploiting one another. There is never an atmosphere of mutual resentment and dissatisfaction, for everyone lives in peace with his neighbour. Such a society, in short, is a haven of contentment and well-being.

In its external form then, Zakat is an annual tax. But in its essence, it is the principle on which God and his creatures have a right to a share in one's property.

The Ramazan Charity

Zakat-al-Fitr is specifically related to the month of fasting and is given before the special Eid prayer. The reason for this Zakat is two-fold. According to a Hadith reported by Ibn 'Abbas: The Prophet made Zakatal-Fitr obligatory for the fasting person to keep him from idle talk and indecent conversation and to provide food for the needy. Discharging the duty before the prayer is an accepted Zakat while discharging it after the prayer is just sadaqah (voluntary charity).

In its external form then, Zakat is an annual tax. But, in essence it is the principle on which God and his creatures have a right to a share in one’s property.

Zakat-al-Fitr perfects the fast of Ramazan and purifies the fast of any indecent act or speech. It is obligatory on all Muslims: young, old, male and female. Every Muslim who possesses over and above what is needed as basic food for the duration of one day and night must pay Zakat-al-Fitr for himself and his dependants and distribute it amongst the poor and needy. The earlier it is given the easier it is for them to make arrangements, so that they may also take part in the celebrations of Eid without any difficulties.